A 10-piece puzzle is simple to look at and complete, whereas you look at 1,000 piece puzzle and you wonder, where do I start? No two puzzles are the same, nor are two farms identical. The difference in many cases is the land mix. If the farm is in a market area where land can vary significantly from highly productive tillable cropland to less productive pasture and recreational land, the question is often asked, how do I analyze and value each piece of the farm? Or how do I analyze and value the whole farm?

The appraiser’s answer can lie in studying the local market, analyzing each component, and breaking it down based on an equivalency ratio, also known as (ER) in the Sales Comparison Approach. The appraisal theory of equivalency ratios (ER) are found in appraisal problems across all types of properties: commercial, residential and agricultural land. It is appraisal theory to demonstrate that the unitary whole value may not equal the sum of its individual parts. To put it simply, it would be too easy to apply value to the individual piece of the puzzle and add them together.

The ASFMRA (American Society of Farm Managers and Rural Appraisers) and the book: Valuing Rural America: Foundations of Data Analysis, teaches the Land Mix: Equivalency Ratio theory with the application of ‘contributory values’ for mixed properties versus those prices paid for puritan tracts because management requirements are more complex.

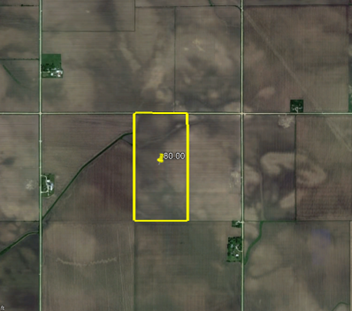

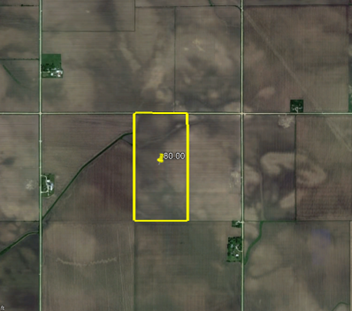

A puritan sale is a one land class property (and very minimal non-productive acres). Example (A), shown below, is an 80-acre farm that sold for $784,000 with 98% tillable acres (78.4 acres of cropland and 1.6 acres in non-productive). The land class- Cropland, would suggest the 100% value to be $10,000/ acre, then CRP at 80%, Pasture and Recreational Land at 50%, and so on.

(Puritan Sale - Example A)

The percentages or $/acre for CRP, pasture, recreational land etc. can come from other puritan sales in the local market area. These percentages are not universal and can vary throughout the market and are driven by the local market forces.

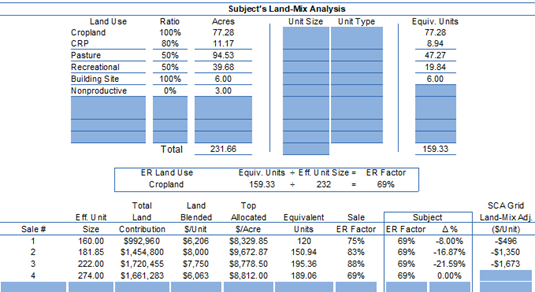

Ratios are important tools that can be used to allocate sale prices in most markets. The overall blended price of the unitary whole is a ratio of the land type identified as the 100% land class in each market. This is further demonstrated by the sale’s equivalency. Within the Sales Comparison Approach, the comparable sales are adjusted (positive or negative) to the subject based on their land mix and equivalency. This is also known as proportional adjustments.

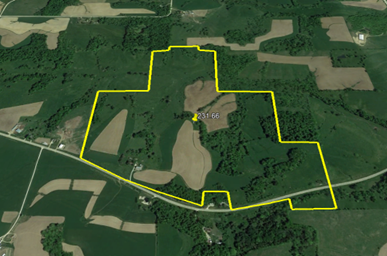

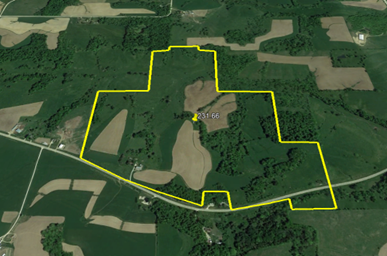

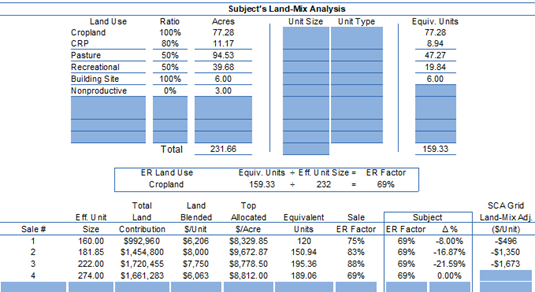

In another example (B) below shows a picture of a 231.66 acre subject property with varying land mix. The subject is analyzed by land mix equivalent acres (units) and how four sales are adjusted in a $/unit to the subject shown on the sales comparison grid.

(Land Mix - Example B)

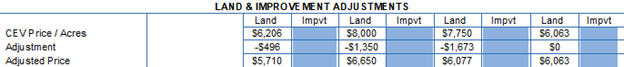

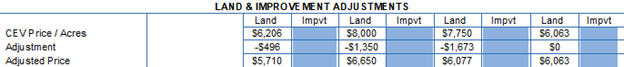

These four sales are then adjusted to ‘equalize’ their land mix to the subject.

These land mix adjustments narrow down the adjusted comparable sale prices.

There would be obvious additional steps to take if the property has building improvements with contributory value, but for simple demonstration, they are not included.

By analyzing and taking an objective view of the land mix of the subject property and the comparable sales, it further validates how the equivalency ratio (ER) can help appraisers value the subject property and complete the land mix puzzle.