The question “Why is farmland a good investment?” typically generates the response from anyone involved with the asset class that farmland investments serve as an inflation hedge, and that farmland also provides important diversification benefits compared to other financial investments. Before the term inflation hedge can be understood, it is important to grasp how inflation is determined and its impact on the economy and, of course, on farmland values.

The Bureau of Labor Statistics (BLS) measures and reports current inflation through various indexes, including the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE), both to monitor a variety of prices for goods and services that consumers buy. These measures refer to a different concept than asset inflation, which is discussed later in the article. Since 2012 under then-Chairman Bernanke, the Federal Reserve has had a long-run target inflation rate of 2% until that guidance was removed in an effort to limit restrictions to the economy’s growth. Several factors can cause inflation, but current inflationary pressures are coming from recent adjustments to fiscal and monetary policy as well as responses to the coronavirus pandemic by the Federal government. Over the last 12 months, we have experienced record fiscal stimulus through the $2.2 trillion CARES Act with the inclusion of total PPP loan funds of $796 billion, monthly government purchases of $80 billion worth of Treasury debt, and $40 billion of residential mortgage-backed securities. An additional proposed $1.9 trillion stimulus is being debated within the House and Senate, and depending on the resolution of the coronavirus pandemic, it could be followed with additional stimulus payments. The current total direct stimulus that legislation has issued for coronavirus relief is tipping the scales at roughly $3.5 trillion. There are not too many statistics that raise an eyebrow except for one recent statement that it is estimated 35% of all the dollars currently in circulation have been printed since March 2020. The disruptions in the economy due to the pandemic have not been partial to the United States, and other global economies are following the trend of relaxed monetary and fiscal policy. An interesting takeaway is the rarity that most global economies have turned on the printing presses, which will encourage inflation globally instead of country-specific. The effect of expanded fiscal stimulus and coordinated monetary policy could easily lead to inflation, meaning that it would take more dollars to purchase something at its current value and to the declining value of the dollar in trade-related applications. An article from Investopedia helps explain the balancing act the government faces in managing the economy. As it is commonly described, the Federal Reserve is allowing the economy to ‘run hot’ by increasing the money supply and devaluing the dollar with a corresponding effort to keep interest rates low. This environment sets the stage for increased farmland values as more dollars would be required to purchase the same acre of farmland, hence the hedge against inflation.

Farmland is a direct benefactor of an inflationary environment, but so are several other tangible assets such as gold and other precious metals, commodities, and even the stock market. Those who have borrowed money will be glad to make their loan payments with inflated dollars against non-inflated loan balances in an inflationary environment. The easy way of explaining this is paying yesterday’s debt with tomorrow’s inflated dollar. An article detailing the significance of the shift in interest rates is available here. Inflation does have negative consequences when left to run rampant in that savers are not rewarded as there is a minimal return on their savings. Those that are reliant upon fixed incomes are squeezed by higher or inflated prices.

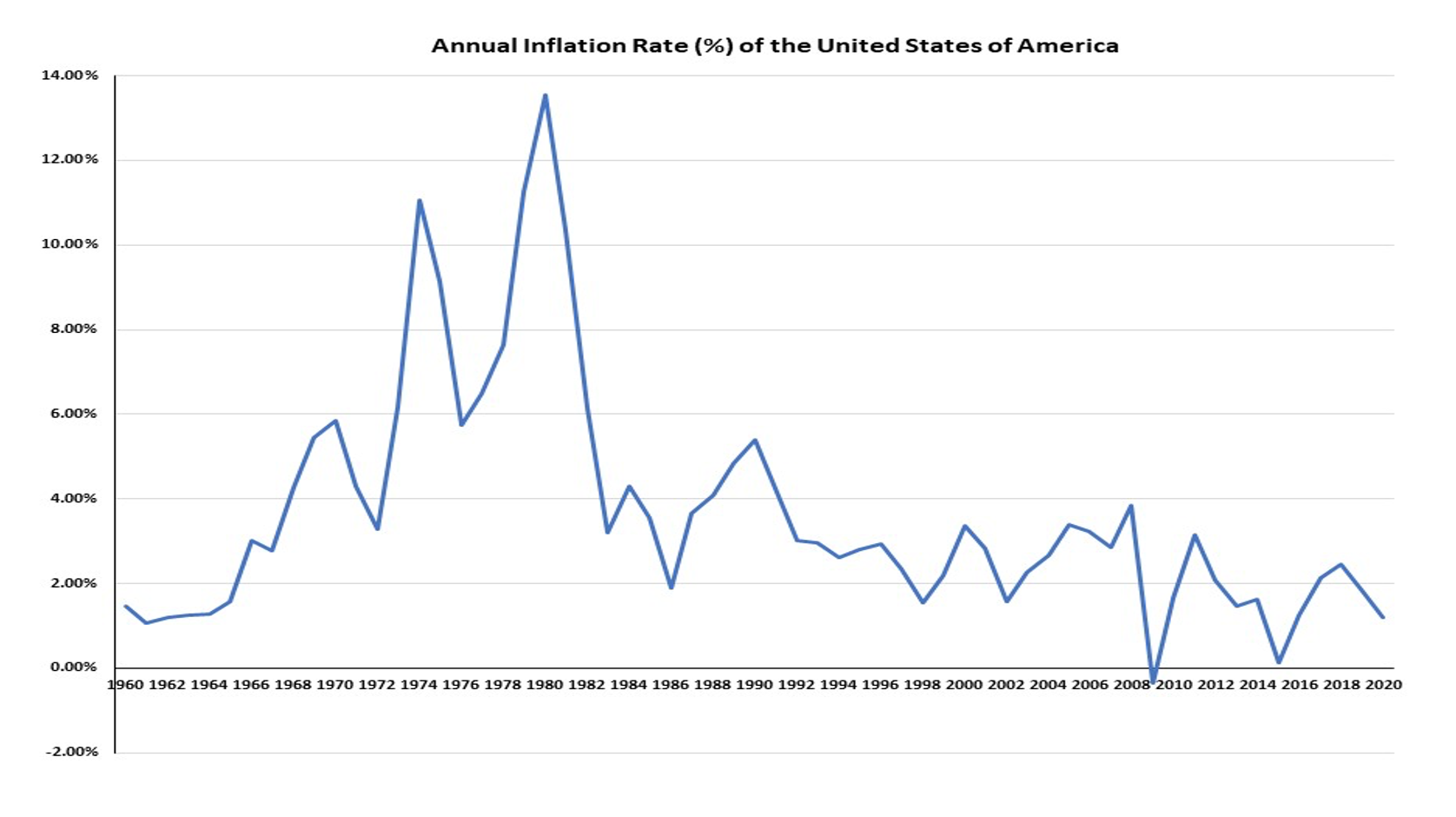

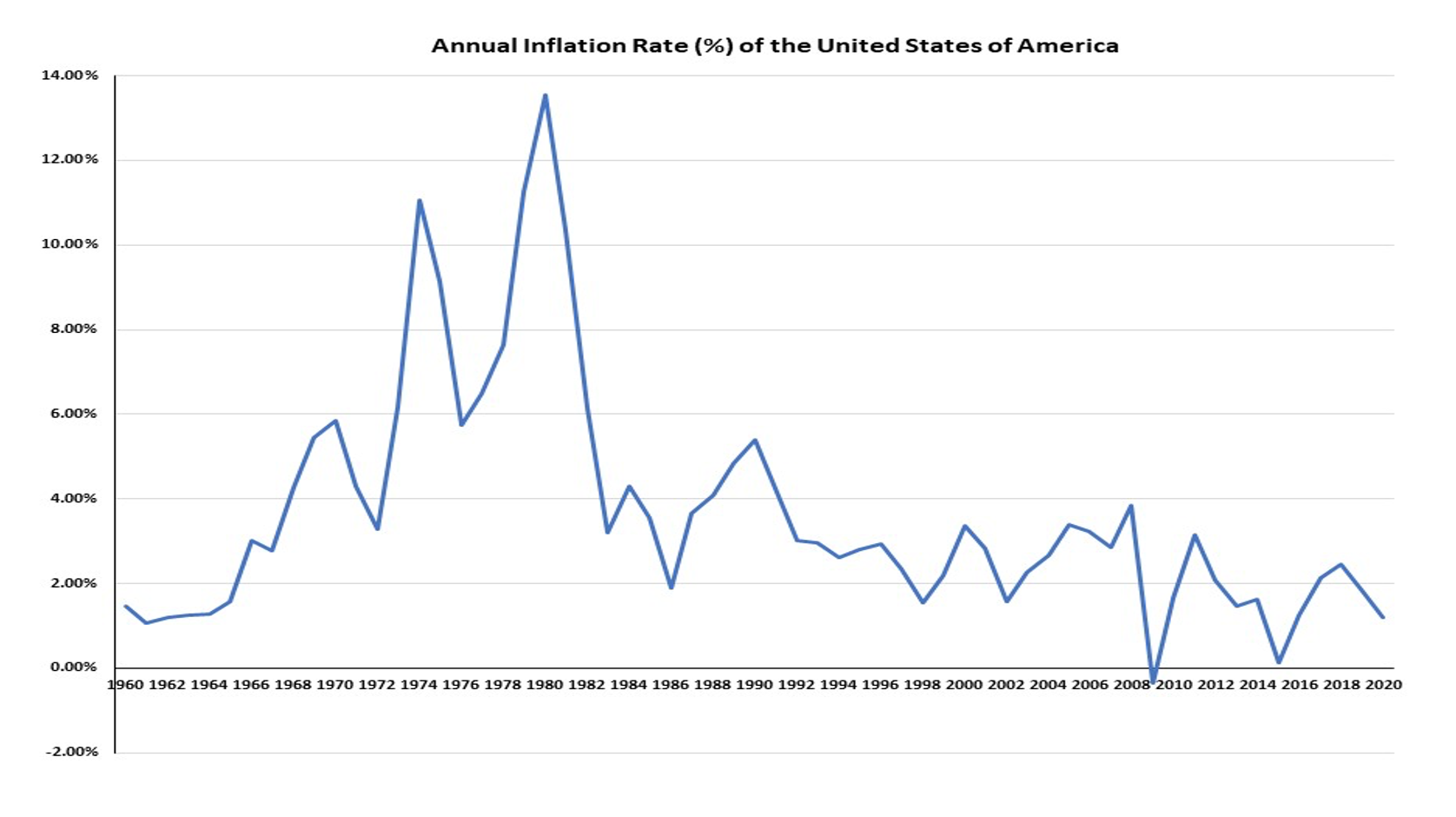

Although recent Federal Reserve measures are conducive to an inflationary environment, recent annual inflation rates in the United States have been quite low by historical standards. The last time inflation reached unhealthy levels was in the 1970s and early 1980s when the Federal Reserve responded by raising interest rates to curb runaway inflation, which ultimately resulted in the 1980s Farm Crisis. Below is a chart that represents the annual inflation rate since 1960, and as shown in the figure, inflation has remained at reasonably manageable levels for the last 30 years.

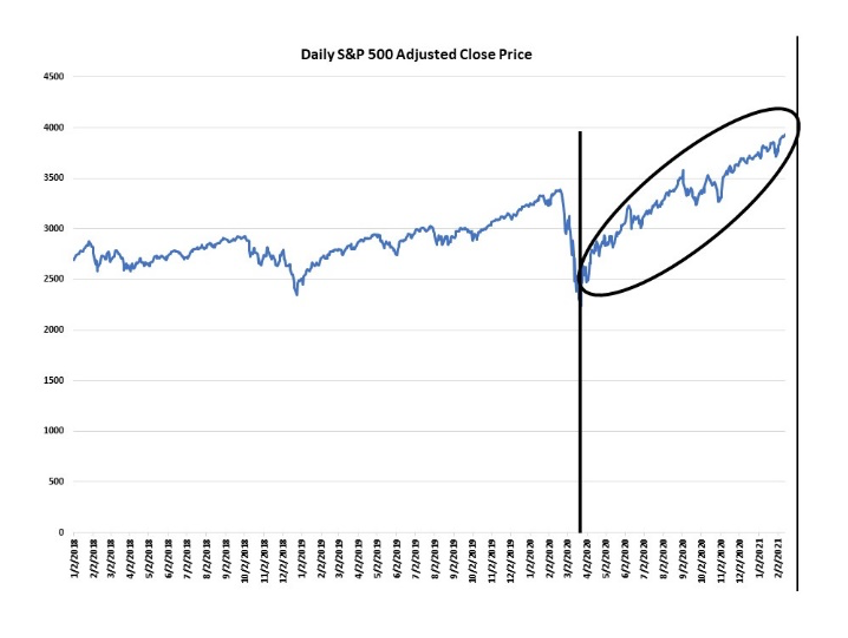

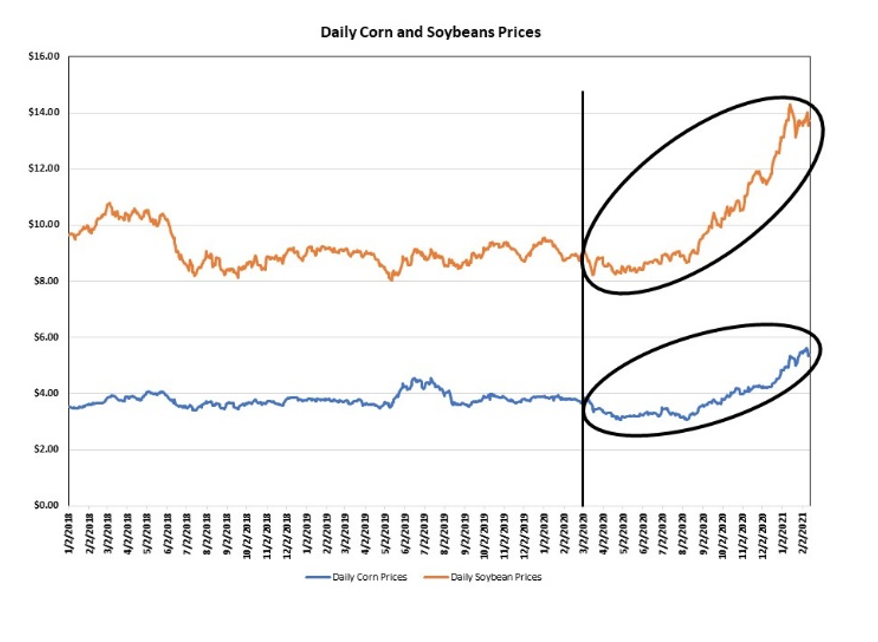

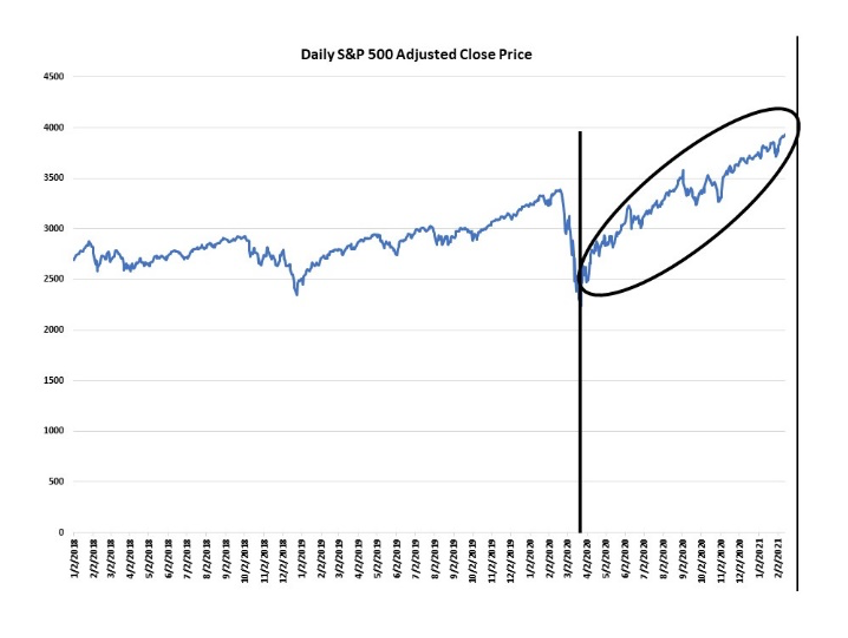

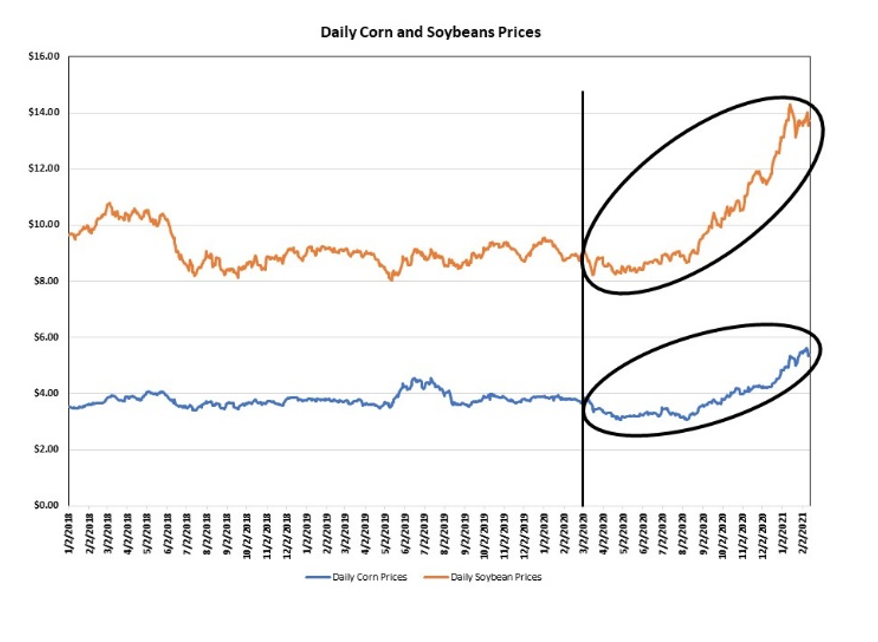

CPI or PCE measures of inflation are generally understood and perceived as the nominal change in prices for broadly consumed goods and services, while asset inflation reflects the phenomenon of increased prices for financial or real assets including stocks, bonds, commodities, and real estate, including farmland. The most recent pump-priming by the government supports the tailwinds, or perhaps is the dominant supporting factor, for the rebound in the stock market, the red-hot housing market, rise in commodity prices, and renewed strength in the farmland market. Asset inflation is not monitored by an index such as the CPI or PCE but instead is specific to the rise in prices for the individual or group of assets. An endorsement for asset inflation can be seen in the two charts below that represent the S&P 500 and corn/soybean prices. Both the S&P 500 and the corn and soybean markets have responded positively since the pandemic surfaced in March 2020 and the subsequent quantitative easing and stimulus deployed to augment the economy. The S&P 500 Index and commodity markets are not necessarily causally related but both have experienced tremendous gains since their 2020 lows, and both have benefitted from the actions taken by the current and former administration relative to fiscal stimulus.

CPI or PCE measures of inflation are generally understood and perceived as the nominal change in prices for broadly consumed goods and services, while asset inflation reflects the phenomenon of increased prices for financial or real assets including stocks, bonds, commodities, and real estate, including farmland. The most recent pump-priming by the government supports the tailwinds, or perhaps is the dominant supporting factor, for the rebound in the stock market, the red-hot housing market, rise in commodity prices, and renewed strength in the farmland market. Asset inflation is not monitored by an index such as the CPI or PCE but instead is specific to the rise in prices for the individual or group of assets. An endorsement for asset inflation can be seen in the two charts below that represent the S&P 500 and corn/soybean prices. Both the S&P 500 and the corn and soybean markets have responded positively since the pandemic surfaced in March 2020 and the subsequent quantitative easing and stimulus deployed to augment the economy. The S&P 500 Index and commodity markets are not necessarily causally related but both have experienced tremendous gains since their 2020 lows, and both have benefitted from the actions taken by the current and former administration relative to fiscal stimulus.

Further support for asset inflation can be noted in the farmland market. The chart below represents Peoples Company specific data of the average dollar per tillable CSR2 point for each quarter dating back to 2015. Farmland was trading at around $112 per tillable CSR2 point for the first quarter of 2020 and $102 per tillable CSR2 point for the second quarter. Sales values in the following two quarters quickly rebounded in both volume and sale prices. The average sale price for the third quarter of 2020 was $116 per tillable CSR2 point and in the fourth quarter increased further with an average sale price of $130 per tillable CSR2 point. The farmland market seemed to advance simultaneously with the uptick in commodity prices in the fourth quarter. Most importantly to note, this chart is showing more than a 25% increase in the overall value of farmland since the second quarter of 2020! Of course, the land market is affected positively by other influences such as a low supply of available farmland for sale, low interest rates, and the rise in commodity prices that has ultimately resulted in asset inflation for the farmland market.

Although current fiscal and monetary policy favors the outlook for increased consumer inflation, the greater, perhaps somewhat less conspicuous phenomenon is the rate at which asset inflation has occurred. Strong political support for continued stimulus relief and commitment by the Federal Reserve to maintain interest rates is based on efforts to spur the economy and avoid further economic demise from COVID-19. As a farmland owner or buyer, what does this mean for you? Farmland buyers are always optimistic when buying farmland since annual appreciation is something to be expected and even relied upon over the long run. Optimism for farmland values is even stronger with the tailwinds of the current bull market with low borrowing costs, a devalued/inflated dollar, and the related expanding demand for commodities. The current farmland market will cause farmland buyers to react differently – some will be excited about the prospect of owning farmland in today’s market, or the elevated prices will direct them to the sidelines while they wait for a price correction. This market pivot also creates an opportunity for the landowner who has been considering selling their farmland as prices have reached or are within the range of their all-time high prices. Similar to the farmland buyer, current farmland owners could find themselves at a fork-in-the-road and choosing between selling their farmland in a hot market or holding onto their farmland, aspiring for continued appreciation beyond the values of today. This time period of recalibration for both farmland owners and farmland buyers creates indecision and a heightened need for information. The value of a farmland professional increases in the market environment we’re in today. It is an opportunity for us at Peoples Company as the collaboration across our core businesses of brokerage/auction, farm/land management, appraisal, and an investment arm allows farmland owners and farmland buyers access to the most up-to-date information and vantage points.

Although current fiscal and monetary policy favors the outlook for increased consumer inflation, the greater, perhaps somewhat less conspicuous phenomenon is the rate at which asset inflation has occurred. Strong political support for continued stimulus relief and commitment by the Federal Reserve to maintain interest rates is based on efforts to spur the economy and avoid further economic demise from COVID-19. As a farmland owner or buyer, what does this mean for you? Farmland buyers are always optimistic when buying farmland since annual appreciation is something to be expected and even relied upon over the long run. Optimism for farmland values is even stronger with the tailwinds of the current bull market with low borrowing costs, a devalued/inflated dollar, and the related expanding demand for commodities. The current farmland market will cause farmland buyers to react differently – some will be excited about the prospect of owning farmland in today’s market, or the elevated prices will direct them to the sidelines while they wait for a price correction. This market pivot also creates an opportunity for the landowner who has been considering selling their farmland as prices have reached or are within the range of their all-time high prices. Similar to the farmland buyer, current farmland owners could find themselves at a fork-in-the-road and choosing between selling their farmland in a hot market or holding onto their farmland, aspiring for continued appreciation beyond the values of today. This time period of recalibration for both farmland owners and farmland buyers creates indecision and a heightened need for information. The value of a farmland professional increases in the market environment we’re in today. It is an opportunity for us at Peoples Company as the collaboration across our core businesses of brokerage/auction, farm/land management, appraisal, and an investment arm allows farmland owners and farmland buyers access to the most up-to-date information and vantage points.

DOWNLOAD PDF

CPI or PCE measures of inflation are generally understood and perceived as the nominal change in prices for broadly consumed goods and services, while asset inflation reflects the phenomenon of increased prices for financial or real assets including stocks, bonds, commodities, and real estate, including farmland. The most recent pump-priming by the government supports the tailwinds, or perhaps is the dominant supporting factor, for the rebound in the stock market, the red-hot housing market, rise in commodity prices, and renewed strength in the farmland market. Asset inflation is not monitored by an index such as the CPI or PCE but instead is specific to the rise in prices for the individual or group of assets. An endorsement for asset inflation can be seen in the two charts below that represent the S&P 500 and corn/soybean prices. Both the S&P 500 and the corn and soybean markets have responded positively since the pandemic surfaced in March 2020 and the subsequent quantitative easing and stimulus deployed to augment the economy. The S&P 500 Index and commodity markets are not necessarily causally related but both have experienced tremendous gains since their 2020 lows, and both have benefitted from the actions taken by the current and former administration relative to fiscal stimulus.

CPI or PCE measures of inflation are generally understood and perceived as the nominal change in prices for broadly consumed goods and services, while asset inflation reflects the phenomenon of increased prices for financial or real assets including stocks, bonds, commodities, and real estate, including farmland. The most recent pump-priming by the government supports the tailwinds, or perhaps is the dominant supporting factor, for the rebound in the stock market, the red-hot housing market, rise in commodity prices, and renewed strength in the farmland market. Asset inflation is not monitored by an index such as the CPI or PCE but instead is specific to the rise in prices for the individual or group of assets. An endorsement for asset inflation can be seen in the two charts below that represent the S&P 500 and corn/soybean prices. Both the S&P 500 and the corn and soybean markets have responded positively since the pandemic surfaced in March 2020 and the subsequent quantitative easing and stimulus deployed to augment the economy. The S&P 500 Index and commodity markets are not necessarily causally related but both have experienced tremendous gains since their 2020 lows, and both have benefitted from the actions taken by the current and former administration relative to fiscal stimulus.

Although current fiscal and monetary policy favors the outlook for increased consumer inflation, the greater, perhaps somewhat less conspicuous phenomenon is the rate at which asset inflation has occurred. Strong political support for continued stimulus relief and commitment by the Federal Reserve to maintain interest rates is based on efforts to spur the economy and avoid further economic demise from COVID-19. As a farmland owner or buyer, what does this mean for you? Farmland buyers are always optimistic when buying farmland since annual appreciation is something to be expected and even relied upon over the long run. Optimism for farmland values is even stronger with the tailwinds of the current bull market with low borrowing costs, a devalued/inflated dollar, and the related expanding demand for commodities. The current farmland market will cause farmland buyers to react differently – some will be excited about the prospect of owning farmland in today’s market, or the elevated prices will direct them to the sidelines while they wait for a price correction. This market pivot also creates an opportunity for the landowner who has been considering selling their farmland as prices have reached or are within the range of their all-time high prices. Similar to the farmland buyer, current farmland owners could find themselves at a fork-in-the-road and choosing between selling their farmland in a hot market or holding onto their farmland, aspiring for continued appreciation beyond the values of today. This time period of recalibration for both farmland owners and farmland buyers creates indecision and a heightened need for information. The value of a farmland professional increases in the market environment we’re in today. It is an opportunity for us at Peoples Company as the collaboration across our core businesses of brokerage/auction, farm/land management, appraisal, and an investment arm allows farmland owners and farmland buyers access to the most up-to-date information and vantage points.

Although current fiscal and monetary policy favors the outlook for increased consumer inflation, the greater, perhaps somewhat less conspicuous phenomenon is the rate at which asset inflation has occurred. Strong political support for continued stimulus relief and commitment by the Federal Reserve to maintain interest rates is based on efforts to spur the economy and avoid further economic demise from COVID-19. As a farmland owner or buyer, what does this mean for you? Farmland buyers are always optimistic when buying farmland since annual appreciation is something to be expected and even relied upon over the long run. Optimism for farmland values is even stronger with the tailwinds of the current bull market with low borrowing costs, a devalued/inflated dollar, and the related expanding demand for commodities. The current farmland market will cause farmland buyers to react differently – some will be excited about the prospect of owning farmland in today’s market, or the elevated prices will direct them to the sidelines while they wait for a price correction. This market pivot also creates an opportunity for the landowner who has been considering selling their farmland as prices have reached or are within the range of their all-time high prices. Similar to the farmland buyer, current farmland owners could find themselves at a fork-in-the-road and choosing between selling their farmland in a hot market or holding onto their farmland, aspiring for continued appreciation beyond the values of today. This time period of recalibration for both farmland owners and farmland buyers creates indecision and a heightened need for information. The value of a farmland professional increases in the market environment we’re in today. It is an opportunity for us at Peoples Company as the collaboration across our core businesses of brokerage/auction, farm/land management, appraisal, and an investment arm allows farmland owners and farmland buyers access to the most up-to-date information and vantage points.