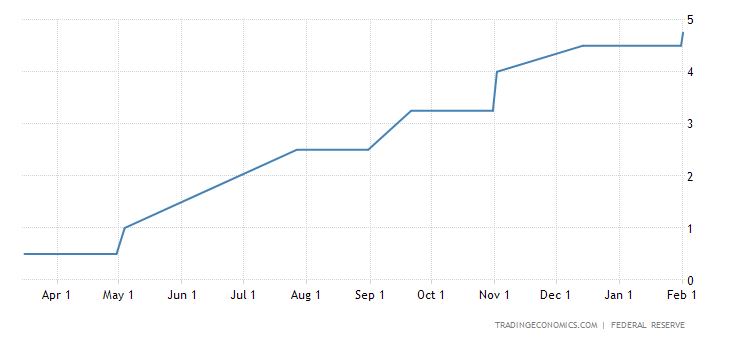

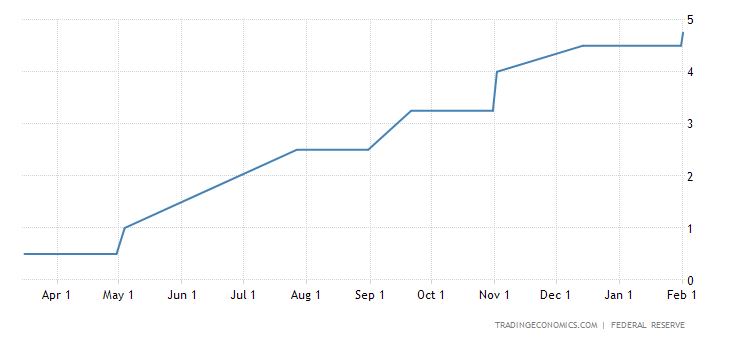

Since mid-2022, the focus has been on the Federal Reserve and the actions they were taking to combat inflation that hasn’t been seen since the 1980’s. Thoughts in the industry went back to the farm crisis of the 1980’s, with fears of seeing a similar situation. According to the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) less food and energy reached a high of 6.6% in September 2022, with food and energy pacing over 10% year over year for most of 2022. This caused the Federal Reserve to begin raising interest rates to cool off the overheating economy.

Source: https://tradingeconomics.com/united-states/interest-rate#:~:text=Interest%20Rate%20in%20the%20United,percent%20in%20December%20of%202008; Retrieved on March 10, 2023

Since May 2022, the Federal Reserve has made incremental increases of 25 to 75 basis points to the Federal Fund Rate in an attempt to cool inflation. Increases to the Federal Fund Rate are expected until inflation reaches 2%.

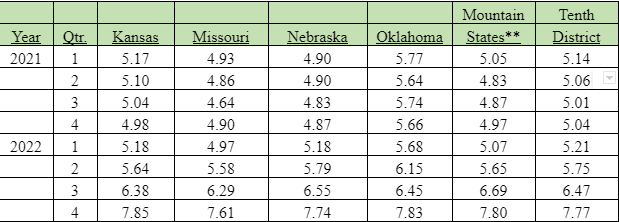

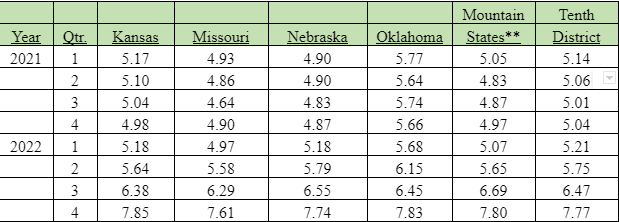

Data provided by the Federal Reserve Bank of Kansas City, which represents the Tenth Federal Reserve District, gives a good picture of the effects of the Federal Reserve’s policy on loans for farmers. The first chart below shows the increase in operating loan rates between 2021 and 2022. Operating loan rates were consistent between 5.01% to 5.21% in 2021 and Q1 of 2022. This rate increased to 7.77% in Q4 of 2022.

Agricultural Fixed Interest Rates: Operating Loans Federal Reserve Bank of Kansas City-Tenth Federal Reserve District

Quarterly Agricultural Credit Survey

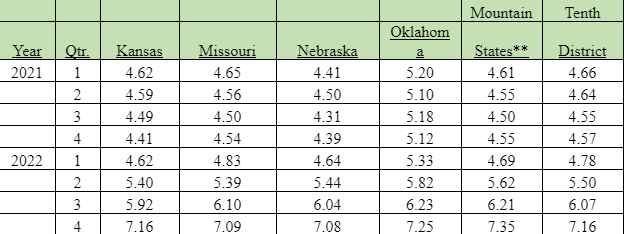

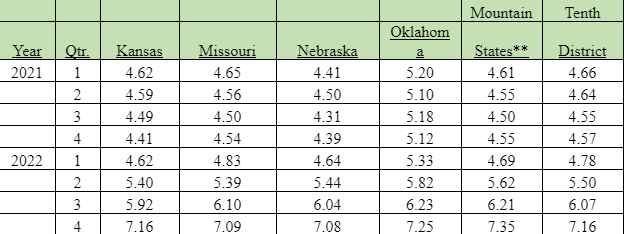

Over the same time frame, interest rates on real estate loans followed the same trend. Real Estate loans for the 10th Federal Reserve District ranged between 4.55% to 4.78% in 2021 and Q1 of 2022. This rate has increased to 7.16% in Q4 of 2022.

Agricultural Fixed Interest Rates: Real Estate Loans Federal Reserve Bank of Kansas City-Tenth Federal Reserve District

Quarterly Agricultural Credit Survey

Source https://www.kansascityfed.org/agriculture/ag-credit-survey/; Retrieved on March 10, 2023

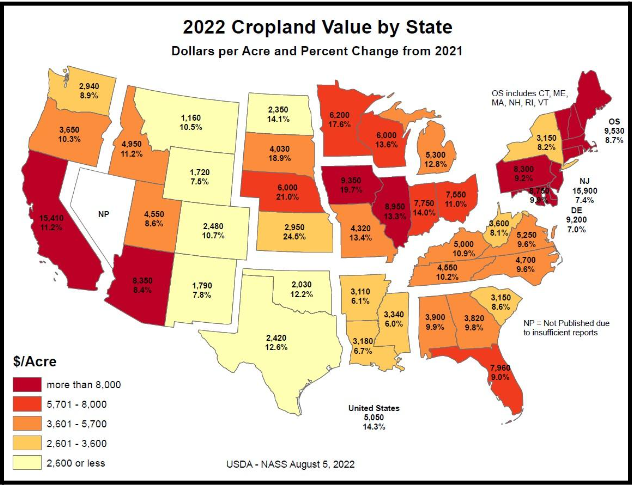

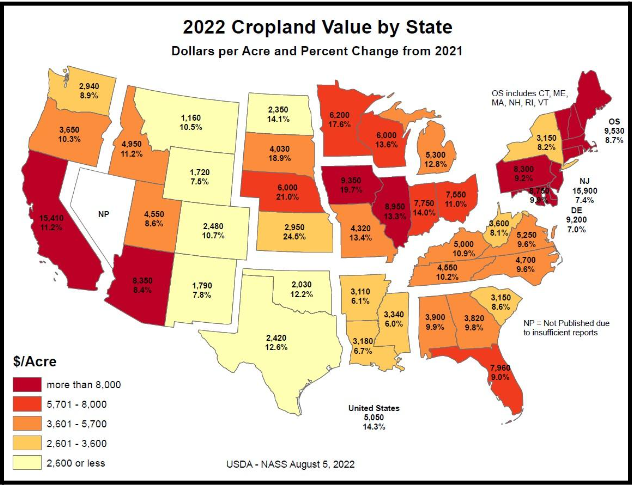

In this same timeframe, we saw the continuation of record high land values throughout the United States. According to the USDA, the United States saw cropland values increasing by 14.3% between 2021 and 2022. Nebraska, Kansas, Iowa, and Minnesota saw some of the largest increases from 13.3% to 21% respectively.

Source: https://www.nass.usda.gov/Publications/Todays_Reports/reports/land0822.pdf; Retrieved on March 10, 2023

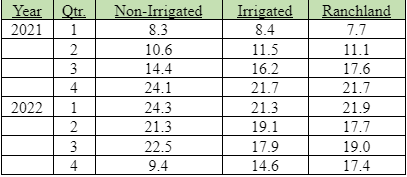

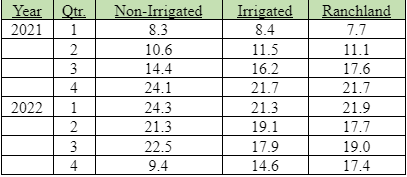

The question remains, how has increased interest rates affected the market for agricultural land, especially at the end of 2022. Data provided by the Federal Reserve Bank of Kansas City shows values for non-irrigated, irrigated, and ranchland followed the same trend for much of 2021 and 2022. Strong farm profits and limited supply of land lead to values skyrocketing in the end of 2021. Uncertainties in the global market caused by the war in Ukraine, along with increased meat prices, carried the momentum throughout most of 2022, which caused all three land classes to jump in value. In Q4 of 2022 you can see the effects of increased interest rates on land values. Non-irrigated cropland saw the largest adjustment, with the rate of increase dropping from 22.5% in Q3 to a 9.4% increase in Q4. Both irrigated cropland and ranchland also saw decreases; however, strong demand for these property types helped to moderate the decrease.

Farmland Values-Annual Percent Changes Federal Reserve Bank of Kansas City-Tenth Federal Reserve District

Quarterly Agricultural Credit Survey

Source https://www.kansascityfed.org/agriculture/ag-credit-survey/; Retrieved on March 10, 2023

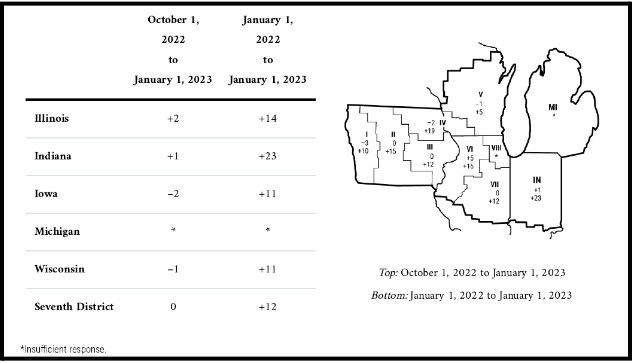

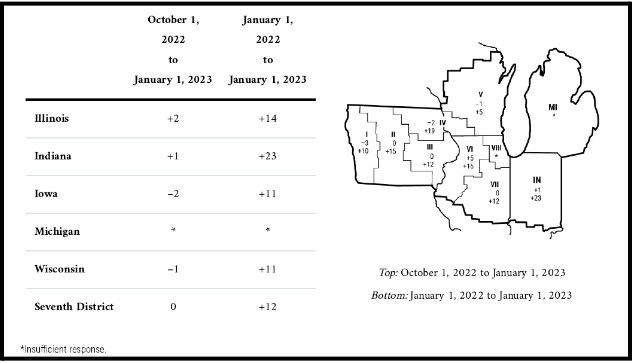

The 7th Federal Reserve District, which comprises portions of Illinois, Indiana, Iowa, Michigan, and Wisconsin, showed a district wide increase of 12% between January 1, 2022 and January 1, 2023. Indiana accounted for the vast majority of this increase, with a year over year increase of 23%. Looking at Q4, we can see that the value increase dropped off even more than in the 10th Federal Reserve District. The district as a whole saw no gain in Q4, with individual states ranging from an increase of 2% to a drop of 2%.

Source: https://www.chicagofed.org/publications/agletter/2020-2024/february-2023; Retrieved on March 10, 2023

How do these national changes relate to your operation or the operation you are appraising? As we can see, the drastic gains we saw for most of 2021 and 2022 are starting to back down, however, values are still increasing. Communication with local players shows a strong demand for farmland out of the necessity to expand, however, there is hesitancy to purchase large tracts of land due to the higher cost of borrowing. Large farmers that are not highly leveraged are looking even stronger in this market, as they can spread out the cost of purchasing in this market over more acres. Demand is still outweighing the increased cost to borrow; however, we may not see the headline grabbing prices as long as interest rates remain high.