Blog by Dave Muth, Managing Partner, Alternative Equity Advisors

The U.S. Department of Agriculture (USDA) administered federal crop insurance program (FCIP) makes U.S. farmland truly unique compared to other investment grade asset classes across the globe. The FCIP provides a minimum annual revenue guarantee for annual asset operations that significantly reduces risks for farmland operators and by extension farmland owners. Created in 1938 as an element of agricultural policy responses to the Great Depression, the FCIP is a permanently authorized program with a dedicated agency, The Federal Crop Insurance Corporation (FCIC) [1]. The FCIC finances FCIP operations through mandatory appropriations. In 2019 the FCIP provided coverage for 124 commodities with over 90% of all corn, soybean and cotton acres insured through the program. In total 379.9 million acres were insured through FCIP in 2019 [1].

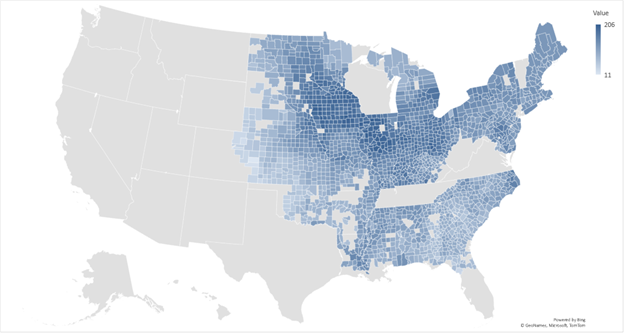

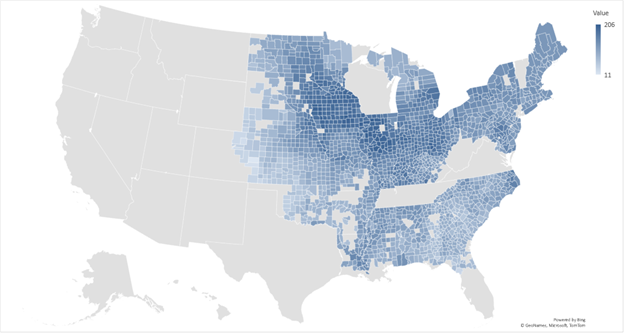

FCIP provides coverage for a wide range of agricultural production perils ranging from adverse growing conditions to commodity market risks. Insurance premiums are subsidized by the federal government encouraging broad participation. Private sector companies are responsible for selling and servicing the policies while the USDA supports premium subsidies, regulation, and reinsurance of the policies. Through this public/private partnership a broad range of policy types and options are available to help customize coverage for the specific needs and characteristics of an individual asset. Actuarial analysis of historical production history and risk at a county level is used to establish insurable yields (T-Yields) by crop [Fig 1][2]. Market price testing is performed using several different approaches suitable to each crop during each annual production cycle to establish insurable crop prices. These mechanisms establish insurable revenue guarantees by crop and county location. Actual Production History (APH) is used to establish insurable yields on assets managed by an operator with sufficient history of production for a crop within the county, or potentially an adjacent county, where the asset is located. Three years is typically the required production history for an operator to establish their APH for a crop and location.

Figure 1. Non-irrigated corn grain T-Yields by county for 2021.

The FCIP is an important and valuable tool for farmland investors to understand and utilize. The key value adds include:

- Minimum annual revenue guarantees

- Underwriting and asset diligence

- Emerging financial incentives

Minimum Annual Revenue Guarantee

The ability to insure a predictable minimum annual revenue for asset operations is substantially valuable. This stabilizes annual asset performance when adverse growing conditions impact productive capacity in a particular year. Every operator and asset will see this annual revenue guarantee calibrate to their APH over time. If an asset has low actual production for multiple years, the insurable revenue will decrease. The ability to have this minimum revenue guarantee is particularly important with newly acquired assets. This provides financial support while building knowledge and expertise needed to optimize management of the asset. Consider an example using Grundy County, IA and the non-irrigated corn T-Yield data provided in Fig 1. The T-Yield for corn in Grundy County is 205 bushels/acre. Assuming the RMA price test establishes an insurable corn price of $5.00/bushel, and the maximum multi-peril election of 85% coverage is elected, this provides a minimum revenue guarantee of $871.25/acre. This provides a predictable and consistent financial return to land ownership and substantially reduces the risk discount factors that would be associated with more variable annual cash flows. Because of this FCIP provides stability for long-term values and appreciation across the farmland asset class.

Underwriting and Asset Diligence

The USDA’s actuarial establishment of county level insurable yields by crop provides a temporally and spatially aggregated dataset that delivers important information to support asset underwriting and diligence. Specifically, this resource can support determination of production potential and stability when evaluating assets as investment opportunities. The risk classifications and relative cost of premiums for an asset or production area can provide valuable insights that support evaluation of the potential and frequency of production perils. Establishing the insurable annual revenue guarantee for an asset provides a clear and delineated maximum exposure for operator and investor for a particular production year. Considering the previous example looking at corn production in Grundy County, Iowa, the assumptions led to a minimum revenue guarantee of $871.25/acre. Assuming total production cost for corn of $550/acre provides a breakeven maximum return to land of $321.25/acre from operations. Applying the same approach to McCook County, South Dakota, the non-irrigated corn T-Yield is 159 bushels/acre. This provides a minimum revenue guarantee of $675.75/acre. Assuming slightly reduced production costs in McCook County of $500/acre because of reduced inputs from lower yield targets establishes a breakeven maximum return to land of $175.75/acre. This basic analysis and data supports quick evaluation of how an asset can perform within an investment portfolio. Applying a 3.0% gross return requirement to the Grundy County example results in an acquisition price of $10,708/acre. The same return requirement applied to the McCook County example results in $5,858/acre.

When acquiring assets from owner operators the annual reporting documents required for FCIP provide a valuable and streamlined information source for asset diligence. Annual reporting and crop insurance claim documents can be requested as part of the diligence process. These documents will provide yield history and details about perils that have impacted production in prior management years. These factors combine to deliver a powerful set of tools for effectively underwriting downside risk in U.S farmland investing.

Emerging Financial Incentives

USDA and the partner private sector insurance providers are currently piloting several programs that incentivize a range of soil health and conservation focused management practices. These incentivized practices include cover crops, split nitrogen application and reduced tillage practices. The pilots are exploring incentives through additional premium subsidies based on long term reductions in production risks through more resilient soils. Emerging FPIC programs focused on sustainability and resiliency align well with ESG objectives from many investment capital providers and also with crop market opportunities meeting consumer values for sustainability and transparency in the food supply chain. The ability to reduce the cost of insurance while achieving priority market access through the implementation of market preferred practices and meeting ESG objectives provides a unique financial opportunity for farmland investors. Additionally, these incentivized practices align with emerging carbon markets potentially providing another revenue stream for farmland operators and owners.

The FCIP plays an important role in making U.S. farmland a stable, reliable, and competitive asset class for investors. Understanding how the FCIP works and leveraging the actuarial data resources for the program can streamline asset underwriting and diligence. A holistic approach to U.S. farmland investing will take advantage of the broad range of benefits across the investment lifecycle provided by the FCIP.

- https://fas.org/sgp/crs/misc/R46686.pdf

- USDA RMA Actuarial Data Master, author’s calculations