By Dave Muth, Managing Partner, Alternative Equity Advisors

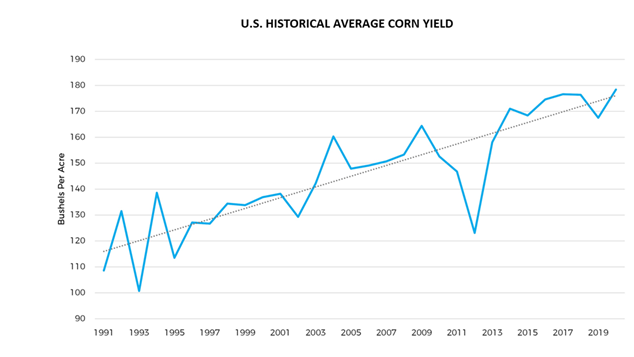

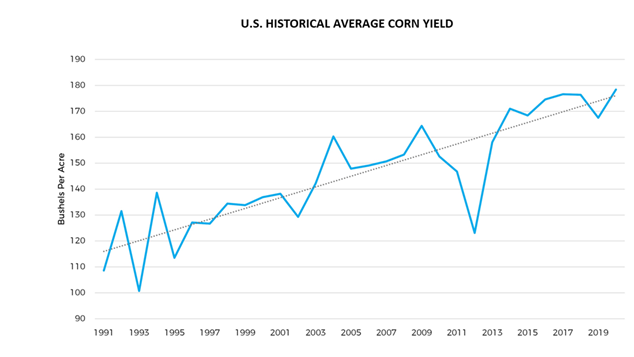

Agriculture remains among the least digitized industry sectors (Fig 1). McKinsey Global Institute’s digitization index rates agriculture with ‘relatively low digitization’ across all the metrics they evaluate in developing their index ratings [1]. This reality will feel incongruent for many agricultural professionals that see data, information, and workflow automation significantly impacting their daily business execution. Technology growth has created real progress in execution and outcomes across all agricultural segments. A clear example of this progress is the consistent and substantial growth in the corn yield curve (Fig. 2). Steady progress in biotechnology, equipment systems, land management practices, and data driven decision frameworks has created a highly impactful outcome. Simply stated, digitization and subsequent implementations of that improved information access have created substantial efficiencies, producing more with less.

Figure 1. McKinsey Global Institute industry digitization index.

Figure 2. US Average Corn Yield: USDA National Agricultural Statistics Service (NASS).

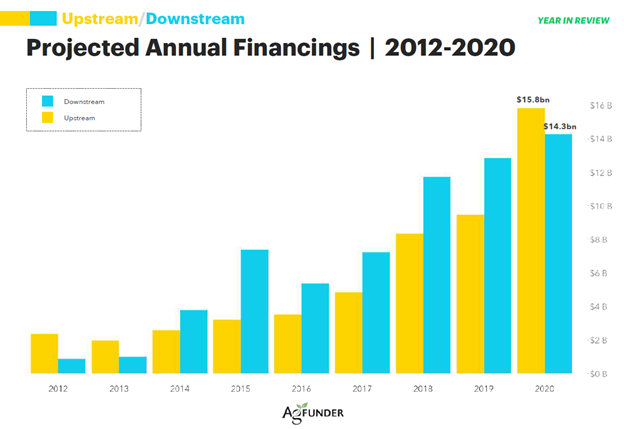

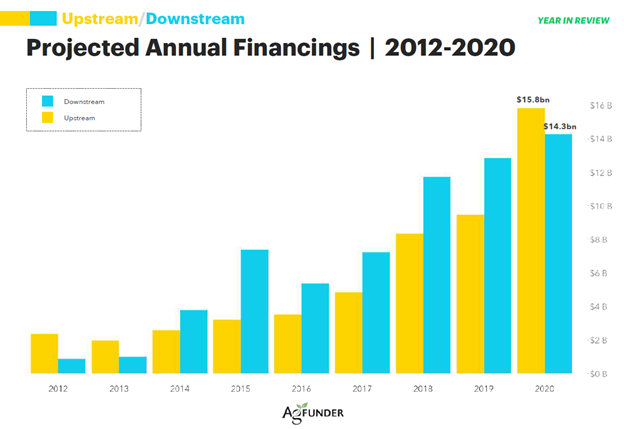

Despite an abundance of clear examples of improved outcomes from technology in agriculture, the sector remains comparatively early in broad digitization. Combining this reality with the existential impacts of agriculture and farmland, more specifically delivering food production and core ecosystem services, has invited growing investment into technology and digitization. AgriFoodTech investments have steadily increased over the past decade, according to AgFunder (Fig. 3)[2]. When considering these technology investment trends from a farmland ownership and investment perspective, the AgFunder reporting identifies a few important and informative themes. First, the technology investment community clearly focuses on enabling consumers to better connect with their food production and supply chain systems. This desire to connect consumable products with the land where it is produced provides broad opportunities for farmland as an asset class. Second, democratizing information across agribusiness segments represents a growth opportunity. Additionally, emerging systems that achieve production and ecosystem goals are receiving significant investment.

Figure 3. Venture Capital Financings in AgriFoodTech by Year.

These factors have combined to create dynamic growth and development in farmland investment opportunities. Professional investors are gaining access to value-added strategies for their assets. Retail investors are gaining access to an asset class that has historically been challenging to find pathways to participation. The following discussion identifies five emerging technologies impacting farmland investing and the professional service providers serving the farmland investment community.

Asset Information Systems

As recently as a decade ago, obtaining baseline information on farmland ownership and core asset characteristics was a highly manual process requiring professionals to engage several disparate information sources. Geospatial data resources, remote sensing technologies, and digital records systems have impacted the democratization of farmland asset information over the past decade. These data sources have remained largely disparate, requiring farmland professionals to aggregate and assemble information into meaningful formats. More recently, platforms are being developed that create integrated data systems that comprehensively deliver core asset data from a single-source user interaction. This digital integration of disparate data resources subsequently allows these platforms to perform value-added analyses, modeling, and forecasting. Platforms including AcreValue [3], LandVision [4], and AcreMaps [5] provide single-source access to information for farmland professionals that delivers more comprehensive and efficient decision-making. Continued progress developing digital record-keeping on water use and availability, coupled with remote sensing systems identifying productivity and management practices, will enhance these platforms creating highly robust asset information resources.

Fractional Ownership Platforms

Farmland has historically been challenging for most investors to engage as an asset class through direct ownership. Transaction volume is generally low, with 1%-2% of farmland changing ownership annually, significant capital is typically required to execute transactions, and ongoing asset management requires specialized, often local knowledge. The democratization of asset performance information mentioned previously is being deployed to deliver platforms that overcome these challenges and give retail investors access to the investment performance characteristics of farmland. AcreTrader [6], Farm Together [7], and mAgma [8] are examples of fractional, direct ownership platforms that are currently delivering farmland ownership opportunities to retail investors. These platforms support investments through professional acquisition, diligence, and management. Investors can participate in the professionally managed investment process with capital investments as low as $5,000 in the case of mAgma. These platforms create a pathway for a substantial new source of capital to participate in the farmland asset class. This will provide new transaction opportunities, improve capitalization efficiency, and enhance value broadly across the asset class.

Externalities Valuation Platforms

Farmland has a unique role in modern civilization. The fundamental purpose is to deliver food efficiently and effectively to a growing global population. Broader ecosystem services provided by farmland are essential, and the valuation of these services is emerging quickly. The ability for farmland to sequester carbon has received substantial transactional attention over the past couple of years. Fig. 4 identifies several groups and companies that have recently introduced carbon credit valuation programs for farmland management systems. Additional ecosystem services, including water quality and quantity, biodiversity and habitat, and recreational activities are emerging opportunities to provide additional value to farmland assets. The democratization of asset management and performance information mentioned previously is fundamental for emerging externalities valuation platforms. Initial carbon credit payments have a limited financial impact on farmland asset returns, but emerging climate-smart agriculture initiatives and increasing carbon valuations in the credit marketplace will likely increase the financial opportunity. Stacking ecosystem services beyond carbon will continue to grow value for farmland investors. Consumers of agricultural products show more interest and value in how the land creating their products is managed than any time in history. In combination, the ability to realize value from externalities and consumable products will fundamentally impact farmland value creation.

Figure 4. Companies introducing formal carbon credit transaction platforms in farmland management.

Agribusiness Marketplaces

Over the past several years, significant investment has been made into added transparency and availability for primary agricultural production products. These include seed, crop protection, fertility and biologicals, among several others. Companies like Farmers Business Network (FBN) [9] have provided digital and remote access to key products required for agricultural products. Entrenched ag retail networks have followed suit, creating more streamlined product acquisition workflows. The impact of these developments is that the local and historically high-touch process of assembling the products required for agricultural production has become more democratized. Because of this, farmland asset managers have more tools and opportunities to engage directly in the agricultural production process. This creates opportunities for vertical integration through direct operations in farmland investing and additional return potential for investors from exposure to crop production profits. Direct operations are a well-established practice in many permanent farmland systems, and digital agribusiness marketplaces are creating opportunities for increased direct operations for row crop farmland systems and investors.

Supply Chain Platforms

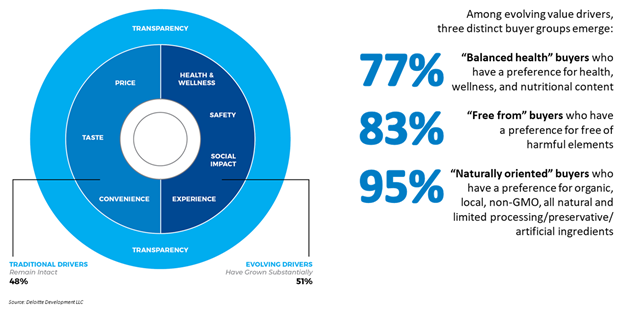

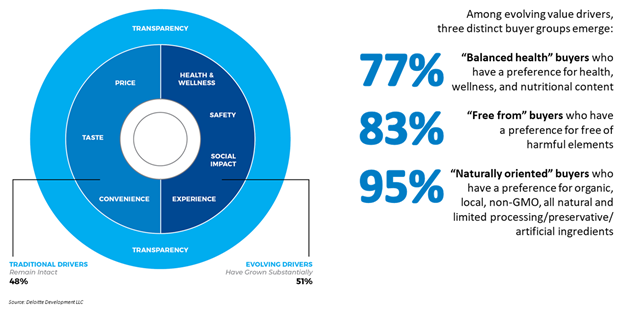

Supply chain technologies and direct-to-consumer food platforms represent 40% of all 2020 agrifoodtech venture investment, according to AgFunder [2]. Consumer values are continuing to shift toward an “evolving” set of drivers that include health & wellness, safety, social impact, and experience [10] (Fig. 5). Consumers are attaching value to these drivers, and the supply chain is digitizing to provide these outcomes. This represents another value-added opportunity for farmland investors. Streamlined supply chain platforms coupled with direct operations mentioned previously can facilitate more transparency between food production and consumers. Farmland investors capitalize on this dynamic to capture more product value and create a higher financial return to the land assets. Additionally, this management practice and supply chain transparency can further enhance financial outcomes as the same information flow is required for externalities value transactions described previously.

Figure 5. Consumer drivers for food consumption.

Conclusions

Agriculture is built around farmland as the most fundamental asset required for production. Agriculture generally, and farmland more specifically, benefit from a significant pace of investment in digital technologies. These technologies deliver new and better value creation opportunities for farmland owners and investors. The five emerging technologies highlighted here are among a broad set of impactful resources developing to create new and exciting opportunities for farmland investing.

References:

[1] McKinsey Global Institute, “Digital America: A Tale of the Haves and Have-Mores”, Dec 2015.

[2] AgFunder, “AgFunder AgriFoodTech Investment Report”, 2021.

[3] https://www.acrevalue.com/

[4] https://www.digmap.com

[5] https://www.acremaps.com/

[6] https://www.acretrader.com/

[7] https://farmtogether.com/

[8] https://magmaland.com/

[9] https://www.fbn.com/

[10] Deloitte, “Capitalizing on the shifting consumer food value equation”, 2015.